Over the past few years, the financial services sector has undergone significant changes. With today’s highly informed consumers, the balance of power has shifted, and they are wielding it effectively. People now expect personalized services and have a strong preference for digital solutions. Simultaneously, industry regulations are becoming more stringent, making it challenging to stay competitive and compliant.

Salesforce is playing a pivotal role in helping financial services organizations navigate this digital disruption. It offers a connected platform that allows them to intelligently handle their sales, engage with customers effectively, and streamline their business operations while adhering to strict industry regulations.

You might be wondering how financial service firms like banks, insurance companies, and investment firms can benefit from Salesforce. To understand this better, let’s explore real success stories who have leveraged Salesforce for financial services. Discover how Salesforce has enabled these companies to provide exceptional service and achieve remarkable success – and how it could do the same for you.

What is Salesforce Financial Services Cloud

Salesforce Financial Services Cloud is a specialized CRM (Customer Relationship Management) platform tailored for the financial services industry. It offers a comprehensive suite of tools and features designed to help financial institutions such as banks, insurance companies, and wealth management firms effectively manage customer relationships, streamline operations, and ensure regulatory compliance. With features like client profiles, financial goal tracking, and integrated analytics, it empowers financial professionals to deliver personalized services, make data-driven decisions, and navigate complex industry regulations. Salesforce Financial Services Cloud enhances customer engagement, fosters collaboration among teams, and ultimately enables financial firms to provide exceptional service while achieving their business objectives.

Why Businesses Prefer Salesforce for Financial Services Instead of Other CRM Solutions

Salesforce stands out as the go-to choice for financial service organizations looking to boost productivity, streamline client interactions, and uncover valuable insights about their accounts and portfolios. Let’s delve into some of the standout features that make Salesforce the preferred CRM for the financial services industry.

Centralized Data Management: Salesforce offers a unified view of your business data, ensuring reliable and instant access. This eliminates the need to duplicate client data across multiple systems, allowing financial professionals to personalize their offerings and gain a competitive edge.

Platform Flexibility: Salesforce offers unmatched flexibility, allowing customization for the unique needs of wealth management firms, banks, insurance agencies, and other financial sectors. Custom workflows can be created without extensive coding, simplifying system scaling.

Security & Compliance: Salesforce prioritizes security and regulatory compliance, integrating security measures into every aspect of its system. Security features, including health checks and multi-factor authentication, protect corporate and client data.

Precise Forecasts: Salesforce CRM provides access to the right client data at the right time, enabling informed financial decisions and precise budget forecasting. It empowers executives to predict future income, assess risks and opportunities, and take timely corrective actions.

Team Collaboration: Effective coordination between finance and sales can enhance forecasting and revenue growth. Salesforce’s capacity to handle vast records effectively benefits financial agents, marketers, and support teams worldwide, ensuring a comprehensive customer data view.

Data Analysis and Visualization: Real-time analytics in Salesforce assists financial advisors and consultants in budgeting, forecasting, and taking immediate corrective measures. AI-powered analytics provide critical insights into the customer journey, revenue, retention, and churn, all presented in customizable reports and dashboards for easy comprehension.

Integration with Third-Party: Salesforce’s AppExchange provides access to over 4,000 compatible add-on products, extending functionality without the need for extensive coding. Insurance agents and financial consultants can seamlessly add features like virtual document signing, advanced search capabilities, and PDF portfolio generation.

In summary, Salesforce’s robust features, flexibility, security, and integration options make it the top choice for financial service organizations aiming to excel in a competitive and regulated industry.

Related Read: Types of Salesforce Clouds

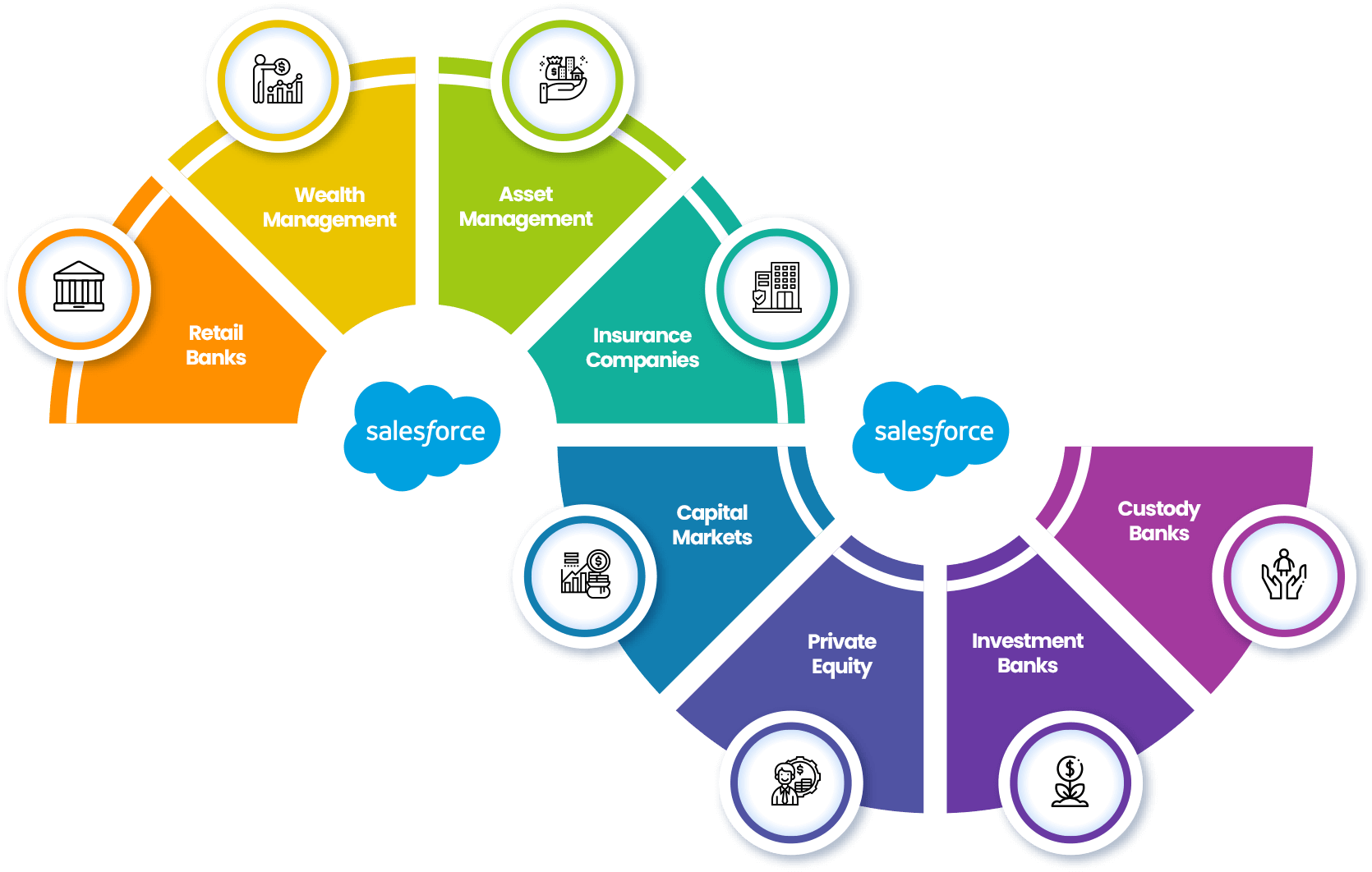

How Financial Services Organizations Are Using Salesforce

Let’s dive into the exciting part: Who’s currently harnessing Salesforce for financial services and in what ways?

Discover How Salesforce Serves:

- Salesforce for Banks

- Salesforce for Insurance

- Salesforce for Investment & Wealth Management

How Banks Utilize Salesforce

Banking and lending institutions rely on Salesforce Financial Services Cloud (FSC) to revolutionize their customer engagement. FSC ensures timely and relevant insights, seamless communication, and cross-device accessibility. It empowers institutions to visualize and monitor customer relationships, facilitating streamlined handoffs and coordination among stakeholders.

Here are some key benefits of Salesforce Financial Services Cloud for the banking sector:

Automated Commercial Lending Tracking: FSC automates and tracks the progress of commercial lending operations, enhancing efficiency and reducing manual work.

Enhanced Retail Banking Customer Care: It standardizes top-tier customer care in retail banking, ensuring a consistent and personalized experience for clients.

Customer Journey-Based Service Forecasting: FSC forecasts service requests based on the customer’s journey, aligning services with their needs and preferences.

Regulatory Compliance for Consumer Lending and Mortgages: Banks can effortlessly adapt to regulatory changes in consumer lending and mortgages, minimizing compliance-related challenges.

Salesforce FSC empowers banking and lending institutions to deliver exceptional customer experiences, remain agile in the face of regulatory changes, and achieve operational excellence.

How Insurance Sector Utilize Salesforce

Salesforce Financial Services Cloud revolutionizes how insurance companies operate, meeting the distinctive demands of policyholders. With 360-Degree Views, customer service reps and agents gain a comprehensive understanding of policyholder milestones. Intuitive dashboards, real-time analytics, and insights guide coverage recommendations. Notable benefits include:

Efficient Onboarding Workflows: Streamlined onboarding processes enhance efficiency, reducing administrative burdens.

Next Best Offer: Salesforce suggests the most suitable offers for policyholders, increasing upselling opportunities.

Comprehensive Customer Journeys: Detailed post and pre-transaction customer journeys provide insights for tailored interactions.

AMS/PAS Integration: Seamless integration ensures a 360-degree customer view, promoting holistic customer service.

Salesforce Financial Services Cloud empowers insurance companies to excel, delivering personalized services, optimizing operations, and fostering lasting customer relationships in this competitive industry.

How Investment & Wealth Management Firms Utilize Salesforce

Salesforce for wealth management is a game-changer for investment and wealth management firms. It streamlines processes, enhances client engagement, and ensures compliance. Here’s how these firms utilize Salesforce:

Client Relationship Management (CRM): Salesforce enables firms to build and nurture strong client relationships. Advisors can access comprehensive client profiles, track interactions, and provide tailored investment advice.

Portfolio Management: Salesforce simplifies portfolio tracking and management. It provides real-time insights into asset performance, allowing advisors to make informed investment decisions.

Financial Planning: Investment firms use Salesforce to create and update financial plans for clients. The platform helps advisors develop personalized financial strategies.

Compliance and Reporting: Salesforce ensures compliance with industry regulations. It generates reports and audits, helping firms meet regulatory requirements.

Data Analytics: Salesforce’s data analytics capabilities provide valuable insights into market trends and client preferences. Firms can make data-driven investment decisions and optimize strategies.

Integration with Third-Party Tools: Salesforce seamlessly integrates with other tools, allowing investment firms to access market data, research, and trading platforms.

Salesforce for wealth management empowers firms to excel in a competitive industry, delivering exceptional client experiences while optimizing investment strategies and ensuring regulatory compliance.

Are you looking for Financial Cloud Services?

Use Cases and Success Stories

Salesforce Financial Cloud has been a catalyst for numerous financial services organizations, driving operational enhancements and substantial growth. Let’s explore a selection of practical use cases and inspiring success stories:

1. CreativeMass: CreativeMass, a prominent player in the financial industry, developed Wealthconnect™, a powerful financial advisory tool integrated with Salesforce Financial Services Cloud and Service Cloud. As their customer base grew, they faced capacity challenges in customizing Wealthconnect for various clients, sought to optimize their platform for increased efficiency and cost reduction.To address this, they enlisted TechForce Services, initially for Salesforce app maintenance. Impressed by TechForce’s capabilities, CreativeMass expanded their collaboration, forming a team called Enterprise Readiness to enhance their core product. Over six months, TechForce not only successfully developed the Extended Enterprise Sharing feature but also led innovations like Shield Platform integration, addressing security concerns, and data rollup solutions. This case study exemplifies how CreativeMass elevated its customer service and delivery model through TechForce Services’ Salesforce expertise.

2. TechForce successfully empowered policyholders and advisors of a prominent Australian Financial Services firm ( insurance industry) with Salesforce Lightning. The project involved two custom community portals: one for customers and another for advisors. Customers gained access to their insurance, superannuation, and investment information, enabling self-service updates and reducing reliance on customer support. Advisors, on the other hand, could access comprehensive customer data to provide personalized recommendations and assistance efficiently.

Key challenges included a gap in customer-advisor interaction, the need for a modern customer portal, and the time-consuming nature of phone-based information retrieval. TechForce addressed these challenges with custom-built portals using Salesforce CMS, ensuring alignment with the organization’s standards.

This digital transformation streamlined processes, improved customer-advisor interactions, and enhanced customer experiences. Advisors engaged in more meaningful conversations, and policyholders could conveniently communicate using their preferred devices and channels. Ultimately, TechForce’s agile approach and Salesforce expertise played a pivotal role in this successful project. Technologies used included Salesforce Core Platform, Sales Cloud, Service Cloud, Community Cloud, and MuleSoft Integration.

Read More: A leading Global Financial Services Firm

Talk to Our Experts for Salesforce Financial Services

In the fast-evolving world of financial services, organizations must stay agile to seize new opportunities and address emerging challenges. Salesforce Financial Cloud offers a proven solution to tackle pressing issues, from managing customers to ensuring compliance.

At TechForce Services, we recognize the hurdles faced by financial institutions today. Our commitment is to empower our clients with cutting-edge technology. As a trusted Salesforce partner, we possess the expertise to efficiently implement Salesforce Financial Cloud and other solutions.

If you’re keen to discover how Salesforce Financial Cloud can benefit your business, reach out to us without delay. Our team of experts is eager to understand your unique needs and craft a tailored Salesforce solution. Let’s collaborate to resolve financial service challenges and attain your business objectives.